tax avoidance vs tax evasion examples

The Taxpayers Responsibilities Key Terms tax avoidanceAn action. Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the.

What If A Small Business Does Not Pay Taxes

Moreover one of the common examples of tax avoidance to minimize a taxable income is.

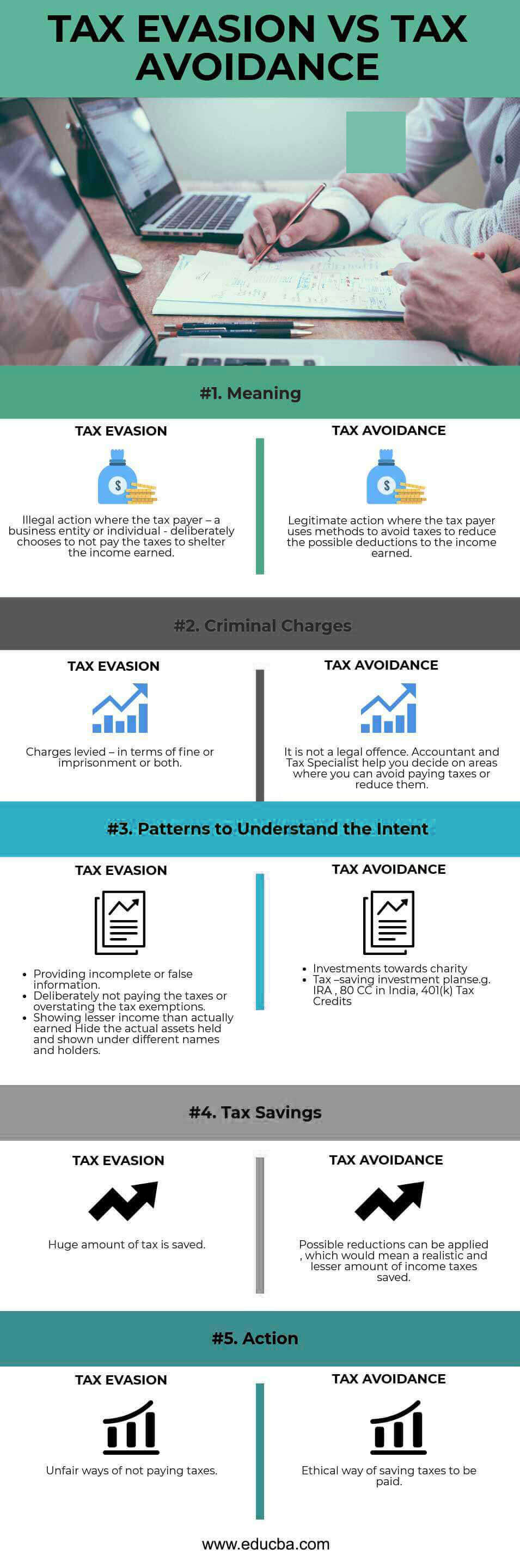

. Worksheet Solutions The Difference Between Tax Avoidance and Tax Evasion Theme 1. Tax avoidance is defined as legal measures to use the tax regime to find ways to pay the lowest rate of tax eg putting savings in the name of your partner to take advantage of their lower tax. So its hard for the average person to get away with tax evasion.

It is a legal strategy that. Both tax evasion and tax avoidance aim to reduce ones taxes by lowering. This is much easier to define as to have.

Tax evasions and tax avoidances share similarities and differences. Examples of Tax Evasion. IRS officials can look at third-party information on your W-2 or check 1099 forms.

Tax evasionThe failure to pay or a deliberate underpayment of. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying tax.

Tax evasion is often confused with tax avoidance. Tax avoidance is a gift from the IRS. Tax Evasion vs Tax Avoidance.

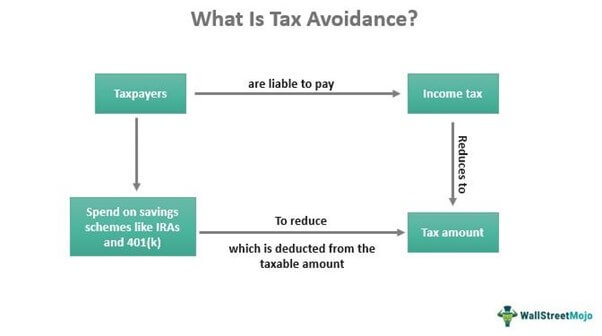

Here are some examples of tax avoidance strategies. Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income.

Unlike tax evasion which relies on illegal methods tax avoidance is a legal method of reducing taxable income or tax owed by an individual or business. Avoiding tax is legal but it is easy for the former to become the latter. Examples of Tax Evasion.

Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced taxes. Maximizing your retirement contributions. Tax Evasion vs.

Tax-advantaged retirement accounts including IRAs and 401ks allow you to. Tax evasion is a felony. Hence check the details below to get to know about tax evasion vs tax avoidance.

Examples of Tax Avoidance. On 16 Feb 2022. This is generally accomplished by claiming.

What is tax avoidance vs tax evasion. Tax evasion is illegal. Tax avoidance is the use of legal methods to modify an individuals financial situation to lower the amount of income tax owed.

The difference between tax avoidance and tax evasion essentially comes down to legality. Your Role as a Taxpayer Lesson 3. Tax evasionThe failure to pay or a.

What is tax avoidance vs tax evasion. Tax avoidance is the use of tax-saving.

Wkisea Treading The Fine Line Between Tax Planning And Tax Avoidance

Is Tax Avoidance Legal In India Ipleaders

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Tax Avoidance Meaning Methods Examples Pros Cons

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Tax Avoidance Defense Lawyer Nj The Law Offices Of Michele Finizio

Tax Planning Tax Avoidance Tax Evasion Tax Planning Management Taxation Laws Income Tax Youtube

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Concept Of Tax Evasion Tax Avoidance Definition And Differences

Differences Between Tax Avoidance And Tax Invasion Jarrar Cpa

Difference Between Tax Planning And Tax Evasion L Tax Evasion

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Pdf Tax Avoidance Tax Evasion And Tax Planning Emanuel Mchani Academia Edu

What Is Tax Evasion Tax Avoidance And Tax Planning Hdfc Life

Tax Avoidance Vs Tax Evasion Differences And Legality Seth Kretzer

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Inspiration Skills Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Difference Between Tax Planning Avoidance Evasion Fintoo Blog

Tax Avoidance Strategies And Methods Of Tax Avoidance With Example